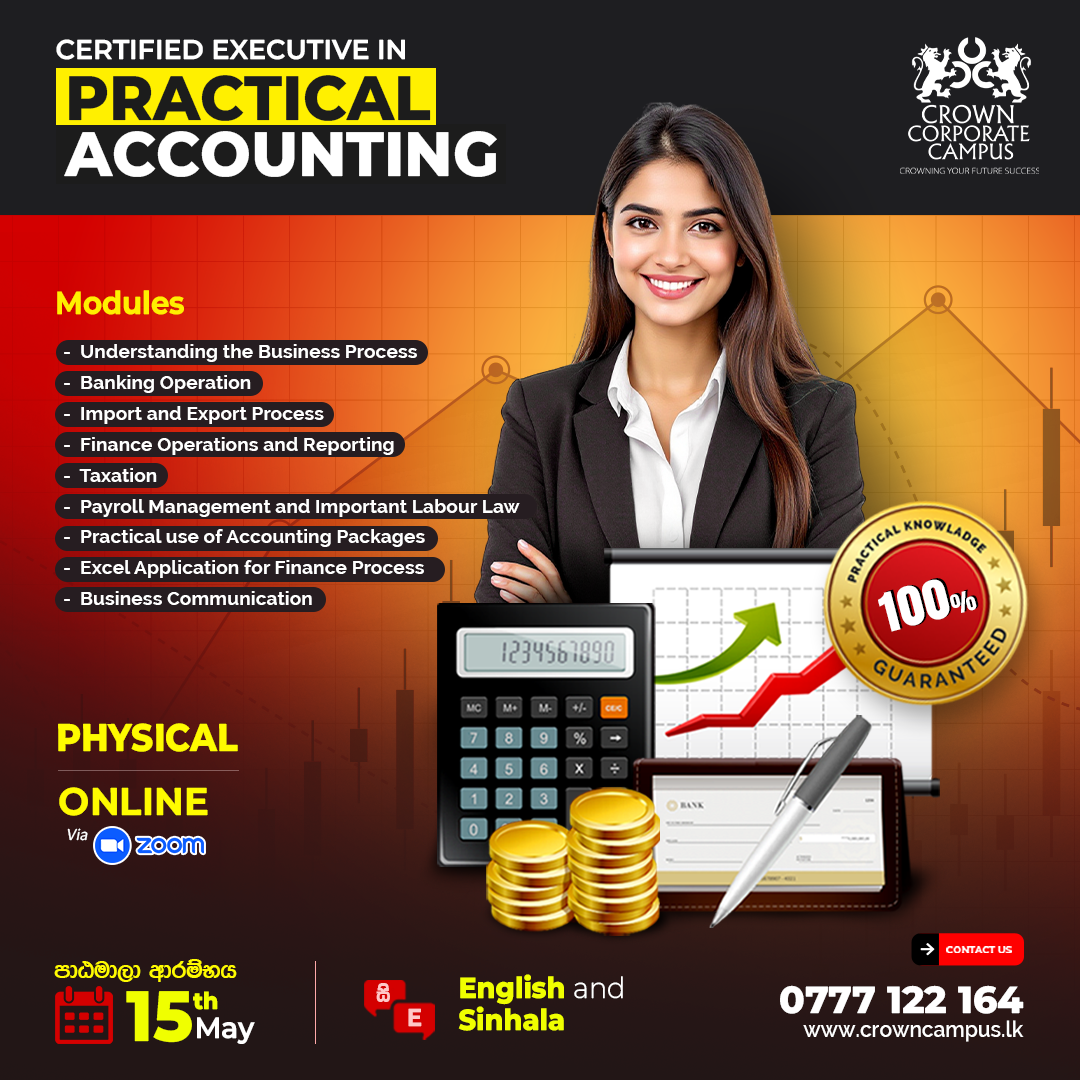

Certified Executive in Practical Accounting (CEPA)

Certified Executive in Practical Accounting (CEPA)

Course Objective

The "Certified Executive in Practical Accounting" course is designed to provide participants with comprehensive, hands-on experience in various accounting practices essential for today's business environment. The objective is to equip learners with the practical skills necessary to manage real-world accounting tasks, enhance their understanding of financial processes, and ensure they are well-prepared to handle the demands of the finance sector. This course is ideal for aspiring accountants, finance professionals, and individuals looking to enhance their knowledge in practical accounting, taxation, and business management.

Course Structure

- Duration

- Class Room Training 6 months, On the Job Training 6 Months

- Format

- Blended learning approach with both online and in-person classes

- Modules

- 11 comprehensive modules covering practical accounting and business management topics

- Certification

- Upon successful completion, participants will be awarded a certificate recognized by industry professionals

Target Audience

- Undergraduate or Unemployment Graduate

- Audit Trainees

- Aat and CA Students

- Students who Passed AL in commerce stream

Mr. Indika Bandara

Mr Indika Bandara is a Chartered Accountant with over a decade of experience in financial management and lecturing. As the Managing Director of Crown Corporate Campus and AnalytixLK, as well as the Director of Online Akura, he has demonstrated exceptional leadership in overseeing strategic business consultancy, tax advisory services, and the implementation of innovative financial solutions. With a rich background as an Accountant, Finance Manager, and Financial Controller, Indika brings deep expertise to his roles. His extensive lecturing experiencehas made him a sought-after educator in accounting, finance, and taxation, helping countless students achieve their professional qualifications.

Course Outline

01 Understanding the Business Process

Understanding the main Business Process

Understanding the Main Source Documents

Internal Controls of an organization

02 Banking Operation

Introduction to Banking and Business Accounts

How to be bankable

Selecting suitable banking products

Digital solutions for banking

Common reasons why organization fail

03 Import and Export Process

Introduction to Import & Export

How to import or export services

3rd party service providers in an import export trade

How to evaluate service provider’s quotations and choose correct party

Port / airport demurrage charges and truck detention charges

How to approve payments to 3rd party service providers

International Commercial Terms (INCO Terms)

How to issue or obtain price for goods in an import export trade

Marine Insurance (Cargo insurance)

International Fund Transfer methods in an Import Export Trade

Basic documents which are compulsory required for Customs clearance

How to collect original documents from bank in an Imports

Procedure to follow when absence of originals in an imports

How to submit original documents to bank in an exports

Harmonized System Code (H. S. Code)

How important of use correct H. S. Code to country’s economy

Calculation of Duty & Taxes in an Import

Reading of Customs Declaration Form (CUSDEC)

Considering value of import products (Valuation) by SL Customs and its practices in an Import

Roles of SL Customs, Airport & Sea Port Authorities

Role of Clearing Agent (Customs House Agency)

Other Authorities engage with Import & Export Customs clearing

Certifications according to the Commodity

04 Finance Operations and Reporting

Account Receivable Handling

Account Payable Handling

Payment Handling

How to Record Day to Day Business Transaction

Bank Reconciliation

Supplier Reconciliation

Stock Verification

Fixed Assets Management

Provisions and Journal Entries

Budgeting

Preparation of Monthly Management Accounts

Preparation of Annual Financial Statements for Audits

05 Taxation

Tax System in Sri Lanka

Income Tax

VAT

SSCL

Tax Administration

06 Payroll Management and Important Labour Law

Introduction to Payroll Management

Understanding Sri Lankan Labour Laws Related to Payroll

Employee Statutory Contributions

Payroll Process and Calculations

Final Dues and Exit Payroll

Payroll Compliance & Documentation

07 Practical use of Accounting Packages

Introduction to Computerized Accounting

Setting Up Your Organization

Chart of Accounts & Opening Balances

Customer & Sales Management

Vendor & Purchase Management

Banking & Reconciliation

Inventory & Items

Financial Reporting

Advanced Features: Automation & Workflows

Security, Data Backup & User Management

Capstone Project & Package Comparison

08 Excell Application for Finance Process

Introduction to Excel

Basic Excel Functions and Data Handling

Logical Functions and Conditional Statement

Advanced Lookup Functions

Data Analysis with Pivot Tables

Data Visualization with Charts and Dashboards

Advanced Excel Techniques

What-If Analysis and Data Protection

Automation and Efficiency in Excel

Advanced Data Management with AI

Financial Modeling with Excel

Final Assessment and Q&A

09 Business Communication

Introduction to Business English in Finance

Financial Vocabulary for Professional Contexts

Writing Emails, Memos, Reports, and Presentations

Listening & Understanding Financial Discussions

Reading and Interpreting Financial Texts

Participating in Meetings and Presentations

Negotiation and Networking Skills

10 Finance Compliance

Effective Filing Arrangement

Dealing with External Auditors

ROC Requirements

11 AI Application for Finance

Certified Executive in Practical Accounting (CEPA)

Elevate your financial expertise with our Certified Executive in Practical Accounting course. Tailored for professionals seeking advanced knowledge, this course offers practical insights and hands-on experience in accounting.